Snapchat has officially announced the launch of Snapchat Partners, its highly anticipated advertising API (application programming interface) which will connect more than 20 tech and creative companies to the advertising platform. The social media messaging application is most popular among Gen X and Gen Ys who use it for posting “stories” compiled of raw photos, videos, text and freakish filters, which have the ability to transform you into a rainbow-vomiting unicorn (amongst other things).

The brainchild of Evan Spiegel and Bobby Murphy, Snapchat, like so many tech companies before it, began on a college campus when two fraternity brothers found out their frat house was closing and were sent packing to a dorm, with all-too much time on their hands.

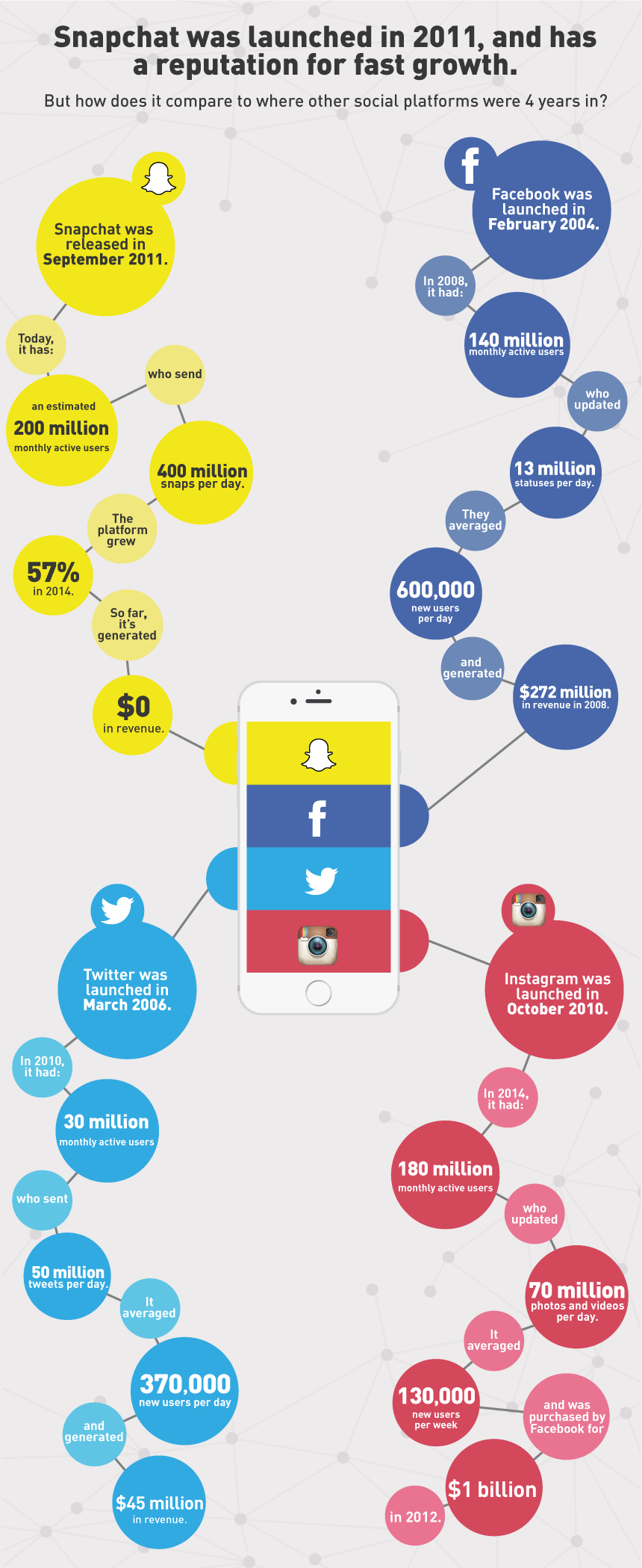

The app has grown rapidly, overtaking its social media rivals Facebook, Instagram, and Twitter for fastest growth measured by user acquisition in a four year period from inception. The app currently has 150 million daily active users and over 10 billion daily video views.

Infographic via WebPageFX

How has Snapchat been able to outgrow its competition so quickly? One word: teenagers.

On any given day, Snapchat reaches 41% of all 18-34 year olds in the United States. Snapchat has given teenagers around the world something they all long for: privacy. Ask a group of teens why they moved to the social platform and amongst the varied responses you will likely hear, “My mom isn’t on there,” or “My parents don’t use snapchat.” Snapchat is also loved amongst millennials and teens for its “rawness.” Stories are only available for a 24 hour period before they vanish forever, making a user’s connection with the people they follow feel more authentic. It is comparable to bumping into a friend in the hallway and catching a snippet of what they are up to that day.

Image via Snapchat

How does this relate to the launch of Snapchat’s advertising API? Well, with the app wanting to increase their revenue, they are capitalizing on the marketing 101 principal that the brand follows the market. If brands want to capture their share of millennial purchasing power, then it makes sense for them to go where these 18-34 year olds are spending up to 30 minutes per day creating and consuming content.

“We want brands to have a place where they can tell their stories… in a better way.”

– Imran Khan, Chief Strategy Officer, Snapchat

The API is promising to dramatically expand the advertising capabilities on the platform in the long run, because “Different marketers have different objectives, and we just want to make it easier for them to buy ads on the platform,” as Khan explains it.

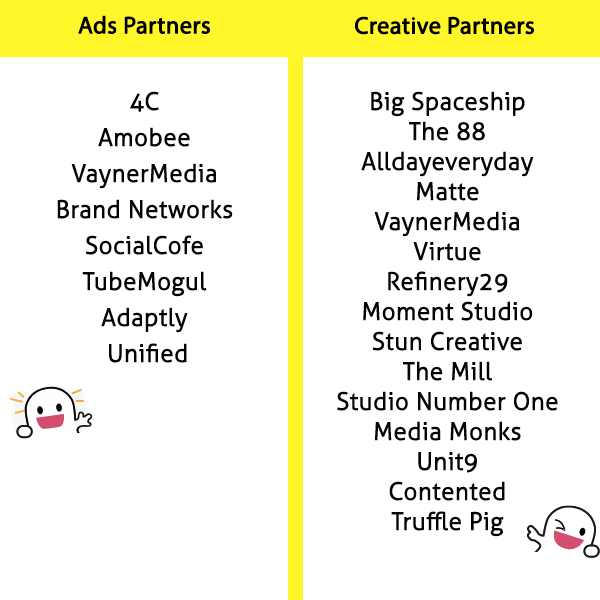

Ads will be sold by third parties for the first time and broken up into two types of partnerships: ads and creative. The first will develop software for Snapchat advertisers, enabling buying, optimizing, and analyzing of campaigns. The latter will represent a variety of creative companies who specialize in a range of social content areas and those who already have experience in 3V, the vertical-video format which Snapchat will be rebranding in the coming weeks as “Snap Ads.”

Snapchat was fairly quiet on the financial arrangement with these partners, however, thanks to Adweek we know that API inventory will be sold via an automated, auction-based system, which will be automatically invoiced to Snapchat, with vendors collecting their fees afterwards.

To ensure user experience is not harmed throughout the development of the new advertising platform, Snapchat is said to be working closely with its partners so that ads are of the highest quality, with a roll out expected in a few weeks.

The current cost-per-thousand-impression (CPM) advertising system in place at Snapchat is closer to TV pricing, and is therefore geared towards higher end brands with big budgets, whereas the newly launched Snap Ads between stories and API videos are predicted to be less expensive.Special events and holidays such July 4th and Black Friday will likely be more expensive based on a supply-and-demand basis.

Snapchat ads have seen 2.5x more engagement than Facebook, 1.5x more than Instagram, 1.3x more than YouTube, greater emotional response and 2x more purchase intent than TV.

– MediaScience x Snapchat study

Recent Snapchat advertising case studies have seen success with millennial engagement. Taco Bell’s Cinco De Mayo branded filter broke records with more than 224 million views – that’s 2,592 people every second – with an average user engagement of 24 seconds before sharing it with friends, equating to over 12.5 years of playtime in one day. It’s important to keep in mind that these are not empty metrics such as “impressions;” these are active engagements recorded by Snapchat in which users take an action by applying the filter, requiring 100 percent of their attention.

Who wouldn’t want to see their head in a taco?

Further to the ads API and partnership developments, what other changes are we going to see made to Snapchat ads? Search Engine Journal sums them up as follows:

1. Snap Ads between stories

Users will now see these in the form of a 10-second vertical video which will appear more frequently between stories.

2. Expandable Snap Ads

When a user sees expandable snap ads they will be able to swipe up to:

– Install a promoted app

– Watch a long-form video

– View an article

– Visit a mobile website

3. Ad Pricing

As mentioned, pricing is expected to be lower than the current CPM based range which is estimated around $40-$60.

4. Ad Quality Score

To help advertisers better understand how ads are performing, Snapchat has been working with Moat, Nielsen, and Google’s Doubleclick. According to Adweek, the new Snapchat-Moat metric comes from a different set of criteria, generating a quality score from 0 to 100 by calculating screen real estate… and time exposed to video and audio. For now, the score is meant to guide advertisers as they weigh a campaign’s effectiveness.

Not all brands are jumping up in excitement over these developments. According to a study from L2, nearly one-third of brands with a Snapchat account don’t even post on the platform once a month. We can, however, expect that number to drop significantly before the holiday season as marketers begin to wake up to the success brands have found on the social app.

These Snapchat advertising developments will give brands greater access to millennial consumer attention. From a marketing perspective, I believe these developments are pushing brands, in particular C-level marketing and advertising executives, to expand their view of advertising spend allocation. In order to remain relevant to younger generations, brands need to be savvy in their approach to advertising, including following their audiences to cutting edge social media platforms such as Snapchat. This also means that brands need to advance their approach to fusing technology and creative, so that they can develop long-lasting and impactful campaigns.